ℬlur NFt

Blur Bidding have quickly become a Olympic sport among NFT traders since it's successful token launch on February 13th, the lure of season 2 rewards and dopamine hit from

The dynamically-shifting landscape of NFTs has recently introduced concepts such as orderbook trading and brought lots of liquidity onboard.

Blur, an NFT trading platform with its governance token, $BLUR, operates within this sphere. Offering unique incentive systems and a peer-to-peer loan protocol, Blur has a significant impact on the market dynamics of NFTs.

However, despite its innovative approach, this essay points out that Blur presently creates a dichotomy between “mercenary” and “genuine” market participants, destabilizes NFT prices, and engenders a cyclic dumping problem, potentially undermining the platform’s long-term sustainability and the overall health of the NFT market.

Blur + Blur Points

Blur is an NFT trading platform. $BLUR is the governance token for the Blur platform.

$BLUR Season 2 Airdrop is a system for rewarding a few types of behavior, using a formula determined by time active multiplied by size.

Blur liquidity providers are rewarded in three ways: Bidding, Listing and Lending. The vast majority of incentive seekers (“farmers”) are opting to use bidding to get points, as it requires only ETH exposure, which is the least risky asset, and can even be hedged with short futures, allowing for theoretically nearly-risk-free farming.

Optimal Legacy Farming Strategy for Blur

Blur Points are awarded on a size and time basis: the longer you participate with more size, the more points you get. This applies to lending, bidding and listing points.

The best strategy to farm points is to bid far enough away to never get filled but close enough to get a fair amount of points.

But what if you get filled? You still want to be bidding but you have NFT assets now. NFT assets on Blur have a 1 hour grace period to sell.

In this case, you would list the NFTs, and in the (very high) chance they don’t get bought, you would simply sell them right back into the bid; then, you’re at full bidding power for at least 12 hours a day, and when you’re not, you’re getting listing points too.

Genuine Liquidity vs. Mercenary Liquidity

Genuine Liquidity

Genuine liquidity refers to liquidity that is stable, predictable and sustainable, or otherwise legitimate. Seeing a $0.01 spread on a $200–500 asset like AAPL or SPY is a result of many diverse market participants acting in different ways. These participants are buying or selling because they have a fundamental interest in the asset itself, or they believe in its long-term value. And because there are so many such actors, they are illustrated on the tape many times per second. In a market with majority genuine liquidity, price movements are more reflective of the true value of the asset, as they are the manifestation of a cumulative result of all market participants.

Examples of genuine liquidity:

Genuine traders using limit orders

An independent small institutional market maker trying to capture spread between bid/ask

A specialized market maker being paid $200,000 per month to keep spreads tight

An automatic market maker system working on a curve like Uniswap pools

Mercenary Liquidity

Mercenary liquidity is less stable and more opportunistic. It is liquidity that comes from participants who are primarily motivated by short-term profits or incentives, rather than a belief in the long-term value of the asset.

In traditional markets, it can refer to short term traders who skip from ticker to ticker on a daily basis trying to chase after pumps.

In the context of DeFi, mercenary liquidity could refer to liquidity that is “farmed” by participants who are constantly moving their assets around to chase the highest yield. These participants are less loyal to any particular platform or asset. Instead, they go wherever they can get the highest returns. If the incentives or yields on a platform decrease, they are likely to move their assets elsewhere.

Examples of mercenary liquidity:

Curve liquidity providers switching pools after incentive readjustments

Stock traders chasing volume on a biotech stock releasing new miracle drug

Blur farmers bidding on 10 collections at once hoping to not be filled

Genuine liquidity provides a more stable market environment, but it can be harder to establish, as it requires building a community of participants who believe in the long-term value of the asset. Mercenary liquidity, while potentially more volatile and less reliable, can be easier to attract in the short term through high yields or other incentives.

In a market with a lot of mercenary liquidity, price movements may not accurately reflect the true value of the asset. Instead, they may be more influenced by changes in incentives or yield opportunities. This kind of liquidity can disappear quickly if conditions change, leading to higher volatility and potentially larger price swings.

Maker vs. Taker

The market has two participants in every trade: a maker and a taker.

Makers are people who add liquidity to markets: one who adds a limit order either on the buy side or sell side.

Takers are people who remove liquidity from markets: people executing in only market orders.

A market with many makers stays stable (think: Coca-Cola stock on a random Thursday).

A market with many takers tends to be very volatile as bids and asks get taken rapidly (think: a biotech stock after a large FDA approval).

It’s worth noting that in many trading markets, makers are rewarded with lower fees or other incentives for their contribution to market liquidity.

In contrast, takers, who reduce market liquidity by executing market orders, are often subject to higher fees. This dynamic is another factor influencing the stability and volatility of markets.

NFTs Are Veblen Goods

Veblen goods contradict the conventional law of demand: their demand rises as their price increases. Unlike most products, where demand drops as prices rise, the demand for Veblen goods increases as their prices go up. This is due to their status symbol appeal. High prices signal exclusivity and desirability, which in turn fuels further demand.

NFTs, in many respects, can be classified as Veblen goods. Their value lies not just in their digital authenticity, uniqueness, or the artist behind them, but also in their perceived scarcity and exclusivity. Owning a high-value NFT is akin to having a rare collectible or luxury item; it’s a status symbol that reflects a certain level of wealth and taste. As such, higher prices can often drive greater demand, as they enhance the perceived prestige and exclusivity of the NFT.

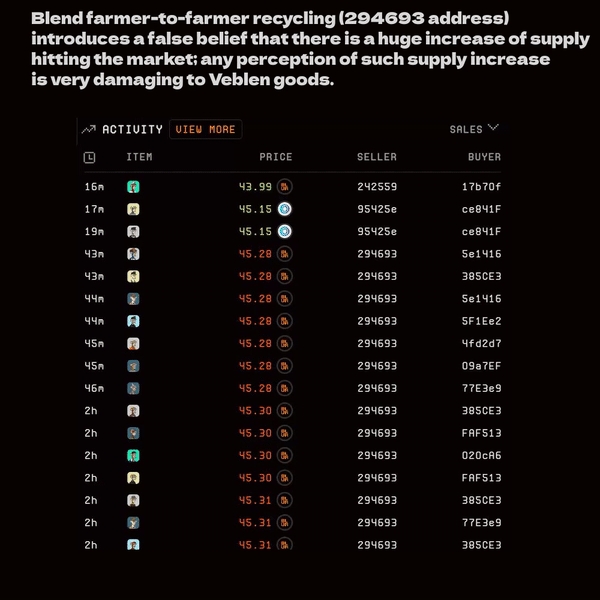

However, this unique demand curve can lead to unintended consequences when supply appears to be plentiful. When a number of NFTs continuously hit the market, as is the case with the behavior of Blur farmers, it can create the perception of an oversupply. This perceived abundance diminishes the perceived exclusivity of the NFTs, which can severely depress demand.

In the world of NFTs where perceived scarcity and exclusivity drive demand, continually showing a large supply can be damaging. Even if the actual value of the NFTs remains unchanged, the mere perception of oversupply can drive prices down.

This further highlights the unique market dynamics of NFTs and the delicacy required in balancing supply and demand. It’s critical to maintain the image of exclusivity and scarcity to sustain high levels of demand and keep prices up.

Traditional Market Making vs. Blur Farming

In traditional market making, market makers have a balance of two assets (for example: AAPL and USD). As the price goes up and down, their balances oscillate and ping pong between having a majority of asset one and asset two. Because market makers are paid consistently, they are willing to take some trading losses and are contractually bound to provide liquidity.

In the Blur market making system, the incentives are heavily reliant on:

1. Other farmers.

2. $BLUR price fluctuations.

3. NFT price fluctuations.

Blur farmers will readjust their size or even consider leaving the incentives program if there are too many farmers — meaning their bids will be behind the large blocks and get little points. They will also leave if there are too little farmers — meaning that their bids will get filled too often and they’ll lose money when they resell into the next bid.

Blur farmers will pull their bids if there is a fast dump in the $BLUR token. They will also dump all of their NFT inventory because they are not trying to hold NFTs. When the BLUR price drops, the amount of USD per point earned is substantially reduced, so farmers are willing to take less risk, and therefore there is a large liquidity drop.

Blur liquidity is leveraged: one Ethereum token can be used to bid on many collections. If a massive clip of an NFT is dumped into a major “market maker” (farming whale) — the bid will dry up on every collection at once, adding major sell pressure as no one wants to be holding the hot potato.

How Blend Accelerates The Decline, A Lot

Blend, Blur’s peer to peer loans protocol, plays an interesting role in shaping farming strategies and consequently, influencing the platform’s liquidity and market dynamics.

Since Blend allows one to get a nearly 100% LTV loan on most of the available assets instantaneously, it functions as a mechanism for farmers to stay liquid and keep bids flowing.

Blend allows for quick and seamless conversions of NFTs back into bidding power, thereby circumventing the typical one-hour grace period for reselling.

Blend provides farmers with the capability to convert their “filled” bids (unwanted NFT inventory) back into farming Blur points almost instantaneously. This enables them to maintain a more continuous and aggressive bidding strategy, fueling their pursuit to maximize points by having bids up nearly 24/7.

Because Blur has removed listing points for Blend-enabled collections and dumpers pay 0% royalty, it’s heavily incentivized to dump ASAP , and over and over— otherwise, you will both pay a fee and not gain any points.

While the functionality is a boon for Blur bid farmers, it inadvertently contributes to the accelerating cycle of ‘dumpers dumping into dumpers.’

As farmers leverage Blend to shorten their NFT hold times and enhance their farming efficiency, it simultaneously magnifies the dichotomy between the two diverging markets — the farmers and the genuine NFT buyers.

This ease of offloading NFTs into the mercenary liquidity bidders pool means that the intended recipients of the NFTs, the genuine buyers, are sidelined and not able to buy the inventory.

The continual flow of NFTs being dumped back into the farming ecosystem leaves less supply for the genuine market, and continues to trade lower and lower every hour as farmers lower their bids by 0.01 continuously to avoid getting filled.

Two Markets Hypothesis

Blur inadvertently created two markets operating simultaneously: one for the mercenary liquidity providers, or Blur farmers, and another for genuine market participants.

The Blur farmers, characterized by their constant pursuit of short-term profits through Blur points, are primarily engaged in a cycle of bidding and Blending NFTs in order to get max bidding points.

On the other hand, the genuine liquidity participants (non-farmer bidders and NFT pickers), interested in the NFTs themselves, contribute to a more stable market; they’re less affected by outside factors.

Normally this would not be an issue with fungible tokens, but given that NFTs are non-fungible, each piece is unique and carries its own value and appeal. This characteristic leads to a distinct dynamic where the two markets rarely, if ever, interact.

Genuine market participants interested in obtaining specific NFTs are unlikely to have the opportunity to buy them from Blur farmers, who continuously dump NFTs into other farmers using Blend. As a result, genuine buyers are sidelined, unable to engage in the market as they would prefer.

The inability of these two markets to interact exacerbates a critical problem: NFT value depreciation. Despite increasing demand from genuine market participants, the continuous dumping by Blur farmers can create a downward pressure on NFT prices.

Therefore, the two-market dynamic inadvertently depresses NFT values and poses a threat to all NFT holders, seeing their holdings’ value diminish, even if genuine demand exceeds supply.

Remember that traits often trade at multiples above floor, so if farmers keep depressing the bids, the demand for above-floor traits also significantly decreases.

I’m a smoothbrain and don’t get it. Can you explain to me exactly how this makes NFTs dump?

Here is an exact rough sketch I sent to Blur on June 2nd, 2023.

Bidders want to bid high for maximum points but do not want to be filled.

Bidders want to bid with as much capital as possible for as long of a time as possible.

Bidders don’t want to hold the asset too long when they get filled.

When they do get filled, they want the best execution possible to get rid of it.

With Blend, the best execution is loan repayment.

This means that farmers will continue to dump into each other at lower and lower bids without new supply hitting the market. Because there are no listing points on Blend collections, assets are always being recycled into lower bids.

Conclusions

— Blur farmers are not market makers: they pull bids on many different occasions in which they should be stepping up in traditional market making incentives.

— Blur inadvertently created a negative bid-ask spread, where selling into bids gives better execution than listing, which adds constant sell pressure.

— Blur farmers optimize for maximum time bidding, which creates a cycle of dumpers-dump-into-dumpers without supply ever hitting organic NFT buyers’ hands (two markets hypothesis).

— The current Blur incentive mechanism allows, and encourages, through incentives, the lower repricing of assets despite no new supply hitting the market, and even if demand outpaces supply.

— The 0.01 ETH order step on Blur bids favors higher priced collections heavily, and lower priced collections get tremendous down pressure from the downticks.

— Blur, through Blend washing, adds additional perception of availability of supply on scarce Veblen assets, lowering the reputation of the industry.

Who am I?

I’m a crypto analyst, trader, and large NFT connoisseur, with many years experience on token economics, social marketing/reputation, and market structure.

Get in touch if you’d like to work together.

Last updated